Automotive & Internal Combustion Engine (ICE) Landscape 2023

Fuel types of new cars in 2022:

Battery electric – 12.1%

Hybrid – 22.6%

Petrol – 36.4%.

In 2022 registrations of new battery electric vehicles (BEVs) continued to grow, despite the overall decline of the EU car market. As a result, market share of BEVs expanded to 12.1%, a 3% improvement over 2021. It was also a strong year for hybrid cars, which achieved a market-share of 22.6%. By contrast, traditional petrol and diesel-fuel continued to lose ground. However, they still accounted for more than half of EU car sales in 2022.

Petrol and diesel cars

Petrol car sales posted a 4.1% growth during the fourth quarter of 2022. All four key markets contributed to this improvement, especially Italy (+17.4%) and France (+3.5%). Despite that, petrol’s market share dropped to 32.5%, from 35.5% in the same period in 2021.

By contrast, diesel recorded a slight decline in the last quarter (-0.4%), while its market share fell to 14.4%, against 16.4% in the fourth quarter of 2021. As a result, full-year diesel car registrations went down by 19.7%, with a market share of 16.4% – 3.1 % less than in 2021.

Alternatively powered vehicles (APV)

From October to December, EU registrations of new battery-electric cars increased by 31.6% to 406,890, as most of the region’s markets recorded growth. Germany led the way with 198,293 and an increase of 66.1%, followed by France which increased by 12.6% to 62,155. After a weak third quarter, EU plug-in hybrid car sales saw a strong rise (+29.5%) in the last quarter of 2022, bolstered by a 73.5% increase in Germany, which alone represented more than half of the region’s registrations in this category. This helped the full-year result to move into positive territory, with 1.2% growth.

Hybrid-electric vehicles (HEVs) totalled 545,316 registered in the EU from October to December last year (an increase of 22.2% compared to the same period in 2021), making them the second best-selling fuel type. This led to an overall increase of 8.6% over the full year, and a market share of 22.6%.

The EU market for natural gas vehicles (NGVs) witnessed substantial declines during the last three months of 2022 (-56.6%), as sales in Italy – the region’s largest market for this fuel type – plunged by 71.3%. LPG-fuelled vehicles, on the other hand, grew by 16.7% from October to December last year.

Alternatively powered vehicles (APVs) accounted for more than a half (53.1%) of the EU car market during the last quarter of the year, with over 1.3 million cars registered in total. On a quarterly basis, this is the first time that APVs surpassed petrol and diesel cars.

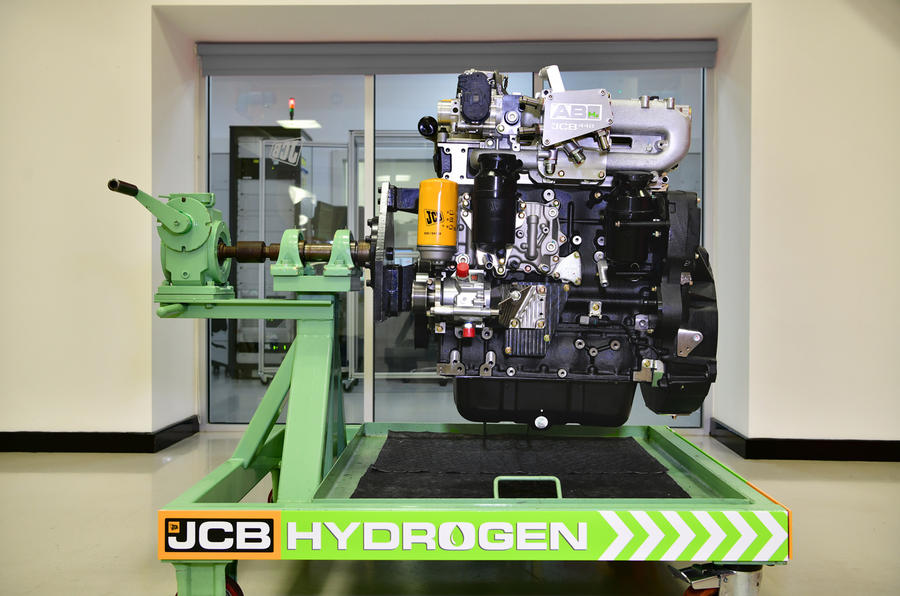

The EU are banning all Internal Combustion Engines, (ICEs) except Hydrogen-fuelled for Heavy Duty Vehicles, (HDVs). So far, the targets for new HDV vehicles have been set to reduce CO2 emissions by 15% by 2025, and 30% by 2030, compared to a 2019 baseline. The EC revised this to set more ambitious targets:

- 45% reduction from 2030

- 65% reduction from 2035

- 90% reduction from 2040

All HDV vehicles are covered by these new regulations, except:

- Small volume manufacturers

- Vehicles used for mining, forestry, and agricultural purposes

- Vehicles designed and constructed for the use by armed forces and track-laying vehicles

- Vehicles designed and constructed or adapted for use by civil protection, fire services and forces responsible for maintaining public order, or urgent medical care

- Vocational vehicles, such as garbage trucks

The EC stated that only battery-electric, fuel-cell, and hydrogen internal combustion engine technologies could be used to meet these goals. As a result, efuels, synthetic fuels, ammonia, and natural gas (NG) will no longer be accepted to comply with this new standard.

More information is available here:

https://ec.europa.eu/commission/presscorner/detail/%20en/speech_23_864

https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_763

EHG Applications in This Ever-Changing Landscape

Up until 2040 the Direct Exhaust injection for emission suppression (AdBlue replacement in HGV’s) remains a strong market opportunity.

Maritime Market Opportunity

- Key to the survival of the Maritime shipping industry is the significant reduction of emissions, as new legislation forces shipping lines to adopt new technologies so they can continue to operate

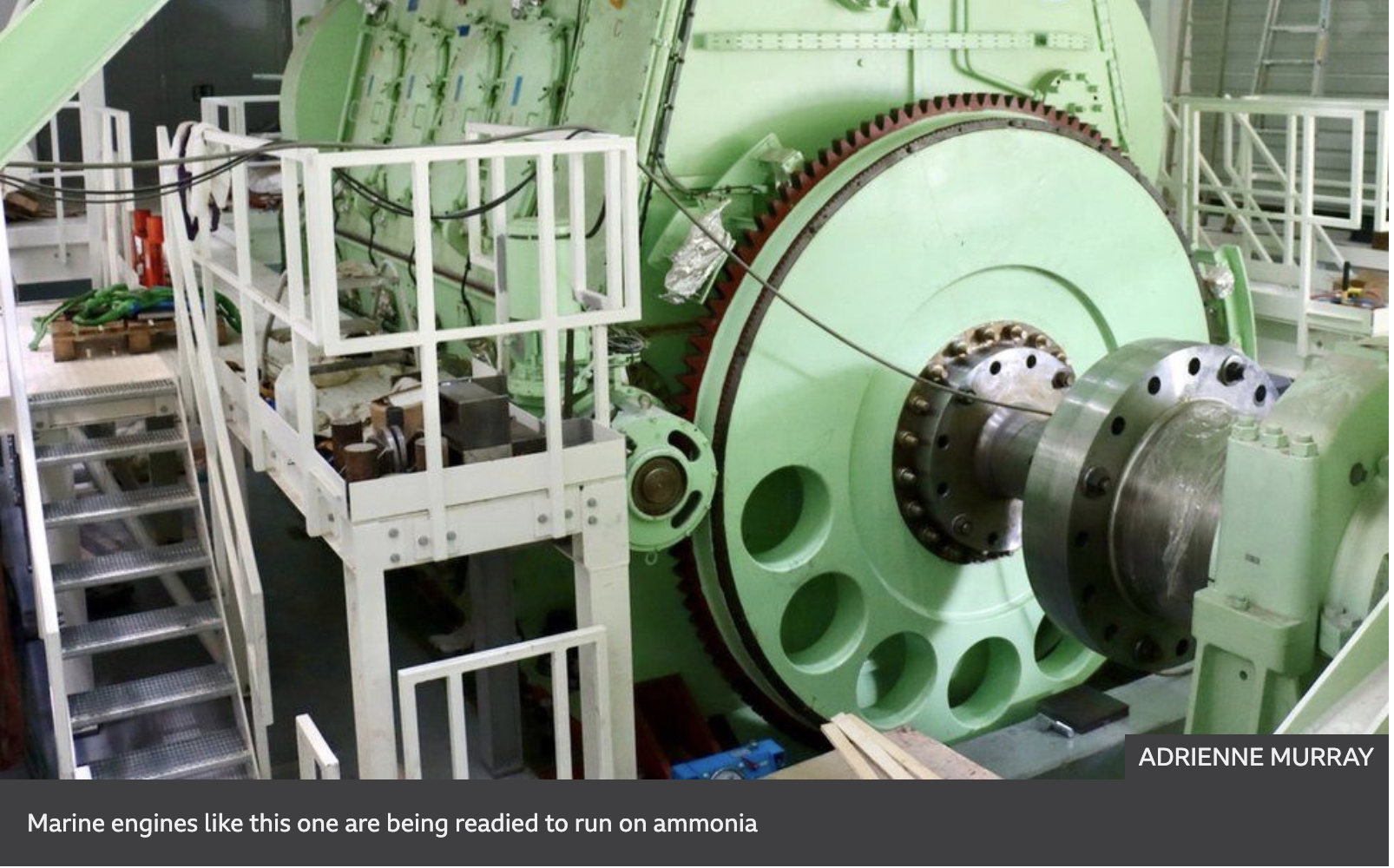

- The challenges surrounding battery-driven ships has helped lead to significant investment into using Ammonia as a replacement fuel for large marine diesel engines. However, ammonia requires the addition of an accelerant to ensure the combustion process is fast enough to deliver the efficiencies and emissions reductions needed for this solution to be effective. Accelerants currently being investigated include natural gas, diesel fuel and hydrogen

- Methanol is another ‘New Fuel’ being discussed for use within the maritime industry. A product created by mixing hydrogen and CO2. The concept is to capture & store CO2 onboard thus complying with the new IMO emission regulations, then unloading it when arriving in port where it is used to create Methanol which the vessel then re-fuels with.

Discussions are currently centred on this solution, but there is a school of thought that suggests an onboard hydrogen production and mixing facility would be a more efficient solution and this plays directly into the EHG’s strengths

- Hydrogen is the focus for almost all the development being done today. Automotive & Marine Solutions is developing the EHG technology in conjunction with Nottingham, Newcastle & Reading Universities to create an efficient ship-borne electrolyser creating hydrogen, using existing waste energy streams to derive non-parasitic rotational force and heat.

EHG Technology offers a green, cost-effective solution to provide an onboard hydrogen solution to the maritime industry at half the cost of existing technologies.

It is also:

- 25% more efficient than existing technologies

- Quicker and simpler to build than existing technologies

- Uses ‘off the shelf’ materials in its construction

- Is being developed in a fully funded ESPCR project incl. Nottingham, Reading and Newcastle Universities